What is a Profit and Loss Statement?

Profit and loss statement for beginners.

A Profit and Loss Statement (P&L) also known as the income statement is one of three main financial documents, including the balance sheet and the cash flow statement. The preparation of these documents are critical to a growing company's proper bookkeeping, and record keeping practices, as they will be necessary overtime as the company grows and expands.

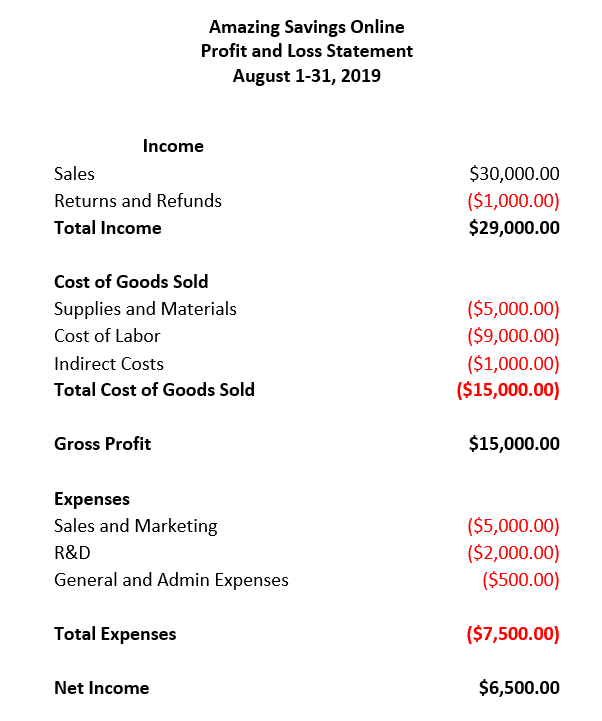

The P&L provides a summary of company revenues, expenses and net profit or loss over a specific period of time, typically monthly, quarterly or annually.

The P&L shows the company revenues from sales of goods or services, and lists all of the company's expenses by main categories. The difference between the revenue and expenses is your profit and loss.

Why Do We Need a P&L Statement?

A P&L statement shows the inner financial workings of a company, and lets people of interest, such as the company's executives, service providers, banks and lenders, insurance companies and investors, better understand what is going on with the company, and to assess the company's financial strength and stability.

As your company grows, transactions increase, product turnover increases, and you start hiring employees, it can be increasingly difficult to keep track of all your revenues and expenses, and the P&L can help you to keep track of everything.

It's important to be able to look at your total revenue and expenses, breaking down the expenses into various categories, such as cost of sales, marketing, administrative expenses, R&D, manufacturing and more.

The P&L statement can also help you to review current performance and establish future projections. Importantly, it also gives you an opportunity to review and compare your performance to other companies in the same industry who have published their P&L statements, allowing you to identify unnecessary expenses and areas of improvement.

See a sample eCommerce Profit and Loss Statement below.

How Banks, Lenders and Investors Use P&L Statements

Banks, lenders and investors all review P&L statements to help calculate a company's risk level. They will usually review multiple P&L statements covering several years allowing them to assess P&L development over time. Therefore, when a company wants to apply for a loan or raise capital, companies will be required to provide evidence of financial standing, and their ability to make constant payouts, including interest and distributions, on time.

A company with a P&L showing low, constant, or unstable revenue is unlikely to get a loan or find investors to raise capital. A downturn or inefficiency in net income (revenue minus expenses) signals to lenders that your company may default on its loan and other debts, and investors may think a company is overleveraged or excessively spends its resources, which means less profits to be paid out to the shareholders. Shareholders will also be concerned that the company is unable to pay off all of its upcoming debts and may fail altogether.

Why Do I Need a Balance Sheet and Cash Flow Statement

To get a full and complete picture of a company's financial strength, you cannot only look at the P&L statement alone. The P&L only shows one part of the picture, and for a full, well rounded understanding of a company's financial status, you must also look at the Balance Sheet and Cash Flow Statement.

In order to prepare any financial document it is important to have proper and up to date accounting records. An online accounting or bookkeeping software such as Quickbooks can be very helpful here.

Balance Sheet

Unlike the P&L which shows financial information over a period of time (monthly, quarterly or annually) the balance sheet shows a company's financial position at one specific moment in time. Which a balance sheet may be prepared monthly, quarterly or annually, the information does not present a change over time, but rather a snapshot of the company at that specific moment.

The balance sheet shows the company's assets, liabilities and owner's equity. The company assets show the company's ability to generate revenue, and the liabilities show future expenses to be paid. The working capital shows how much cash or cash equivalent assets the company has on hand for operations and meeting expenses, and the equity shows the company's value after all expenses have been paid.

Cash Flow Statement

The cash flow statement shows how much cash the company has generated or expended over a period of time. The cash flow statement consists of 3 parts:

- Cash from operations

- Cash used in investing

- Cash from financing

The cash flow statement is used to assess the company's ability to generate cash from operations, free cash flow generation, how much money is raised, a net change in cash position over a period of time, and the company's start and ending cash balances.

What is the Difference between the P&L and Cash Flow Statement?

The simple answer is, it's a matter of the cash vs accrual forms of accounting. The P&L statement tracks revenue and expenses incurred, not cash flow. In a company where the records are on a strictly cash basis, the P&L and Cash Flow Statement will be exactly the same.

However, most P&L statements track revenue and expenses on the accrual method, which means transactions are recorded at the moment they are incurred, without regard to whether or not the cash has been received or paid out.

By the accrual principle of accounting, the P&L works on revenue recognition, by which income and expenditures are recorded during the periods they occur, and not when the cash is actually received or paid, which makes revenue and expenses very different from cash flow, and can result in the bottom line in a P&L and cash flow statement being different.

For example, let's say in August you sell a refrigerator for $1,200 and offer the purchaser an opportunity to pay in 6 equal installments of $200. The August monthly P&L statement would show revenue of $1,200, $200 cash received for the first installment payment, and $1,000 accounts receivable. However, the August monthly cash flow statement would only show the $200 cash actually received.

Equally so, if you purchase a computer on credit and agree to pay in installments, the P&L will show the total purchase price as an accounts payable, but the cash flow statement will only show the amount of cash which has actually been paid out up to that time.

The Bottom Line

A P&L statement shows investors and other interested parties the amount of a company's profit and losses and its breakdown into categories, making it an important and powerful financial tool. Revenue and expenses are shown when they are incurred and not when the money actually changes hands.

Finaloop can assist with quick and accurate creation of a P&L statement for your eCommerce business by extracting information from your banks, credit cards and third party financial applications and connecting everything together in one place. Your Finaloop dashboard with provide you with all your business financial information, and easily create your P&L and all other financial documents, to help you, your team members, service providers, lenders and investors quickly understand your company's financial status.

The information provided on this website does not, and is not intended to, constitute legal advice. All information, content, and materials available on this site are for general informational purposes only. Readers are advised to consult with their attorney or accountant with any questions or concerns.

That’s what we’re here for.

Accurate ecommerce books, done for you.

100% accurate ecommerce books, available 24/7.

Finally, you can focus on everything else.