What Is A Balance Sheet and Why Is It Important

Everything you need to know about Balance Sheets

A balance sheet provides a quick snapshot of a company's financial health. Applying conservative principles, it allows owners, managers, accountants and investors to quickly review and understand what a business may be worth. Given the conservative principles applied, it is possible that that company will actually be valued at much more than presented in the balance sheet. A balance sheet is also called a statement of financial position.

The balance sheets is not a profit and loss statement but rather looks at the company at a specific day and provides a snapshot of the company's financial health. For example, the balance sheet can be created at any chosen moment, though accountants and bookkeepers usually "close the books" at the end of every quarter or month. A balance sheet is one of several major financial statements including the profit and loss statement, and cash flow statement.

A balance sheet is used by companies to raise capital, apply for loans, or for general business planning, making it a very important and powerful tool. By securely accessing your financial and business applications, such as Shopify, Stripe, bill.com, Gusto, Stitch Labs, and banks and credit card companies etc., Finaloop can help your business easily and accurately create a balance sheet for your company within a matter of minutes.

What is on the balance sheet?

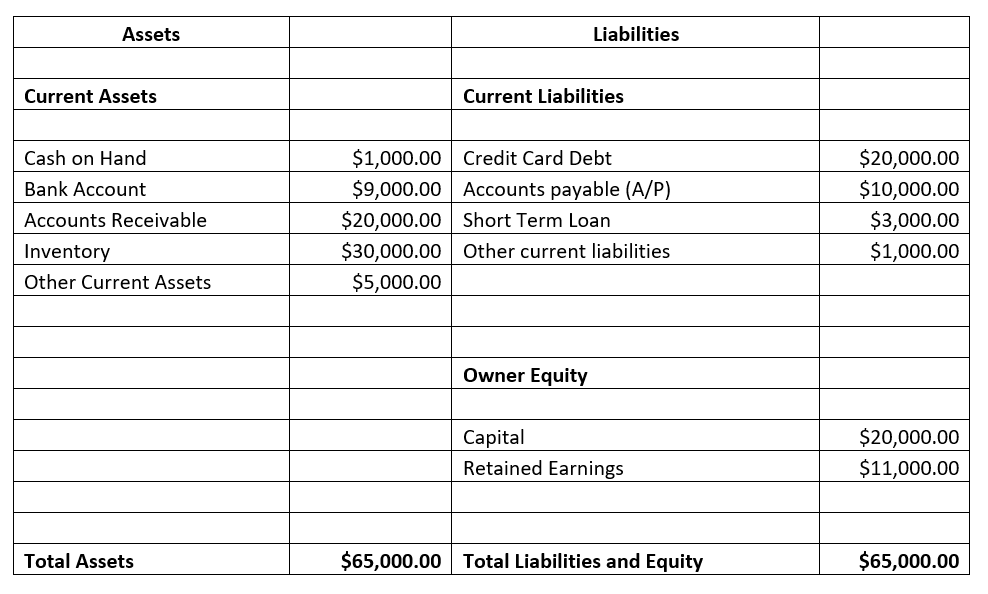

A balance sheet lists all of the company's assets, liabilities and owners' equity. A balance sheet is calculated as Assets = Liabilities + Owners Equity (also called Shareholder Equity). The 2 sides must always be balanced, hence the term "balance sheet". This financial statement provides a snapshot of what a company owns and owes, as well as the amount invested and earned by shareholders as of the time of creation of the balance sheet.

The balance sheet shows how a company puts its assets to work and how those assets are financed as listed in the liabilities section. Shareholders' equity is the difference between assets and liabilities, or in other words, how much money is left over when all the liabilities are paid using the company assets.

What are assets:

A company's assets are the things a business owns and uses to operate. Assets can be both tangible or intangible. The balance sheet breaks down the assets into current assets and long term assets.

Current assets are things such as cash or cash equivalent assets, inventory, marketable securities, and amounts the company is owed and is expected to receive within 1 year, such as accounts receivables and short term investments.

Long term assets are things such as buildings or land, machinery, long term investments, patents, trademarks or copyrights.

What are liabilities?

A company's liabilities are the amounts of money it owes or is indebted and required to pay. Liabilities are broken down on the balance sheet into short term and long term liabilities.

Short term liabilities are debts which are due to be paid within 1 year. Short term debts include unpaid employee wages, accounts payable, loan payments due within 1 year, utilities, medical payment plans, building and equipment rents, expected costs of repair or maintenance of property or machinery, and taxes.

Long term liabilities include things such as long term loans and bonds.

What is owner or shareholder equity?

Owner equity is the value of the company after all liabilities have been paid. If all assets were sold and converted to cash, and all liabilities paid, the equity represents the amount left over which would be split among the relevant owners and shareholders.

Owners equity can include things such as capital (the investments made into the business) and retained earnings, which are earnings generated by the business not paid to shareholders, but rather kept by the company for future growth and investment.

What you can find on an eCommerce balance sheet?

In today's ever evolving world, many people are opening companies to sell their products exclusively over the internet. As time goes on, there will be an increasing number of eCommerce brands in addition to other companies that will continue to sell both online and in store. Every business has its own composition which requires a tailored balance sheet.

eCommerce Assets

An e-commerce company's current assets typically include bank accounts, accounts receivables (amount you are owed) and inventory.

Long term assets, if any, will include an office or property, business vehicle, and manufacturing equipment.

It is important to note that in the early phases of a new e-commerce business, it is less likely to see these items on a balance sheet, as many new ecommerce businesses operate from home, and do not have company vehicles. They also typically outsource the manufacturing of their products, rather than attempting to manufacture the items themselves.

eCommerce Liabilities

An e-commerce company will usually list its current liabilities on a balance sheet, including employee wages, accounts payable, credit card debt, account overdraft, short term loan payments, and tax liabilities (including income and sales tax). Long term liabilities usually include long term loans.

Owner Equity

Finally owner equity for an e-commerce business will usually include any investment made by the company's founder(s) in establishing in the new business and any external capital raised.

Below is an example of a start-up e-commerce business.

##**

How Finaloop can help

The balance sheet is used in preparing and filing your tax returns, including income, sales and franchise taxes. It is also reviewed together with other financial documents, such as the cash flow statement, and profit and loss statement to ensure the company is financially healthy and not running out of cash.

It is critically important for a business to accurately portray its financial status on a balance sheet. Finaloop can access your financial accounts, POS, online store, payment gateway and other business applications to extract the information and create your company's balance sheet in real time. Finaloop automates and handles the bookkeeping and accounting process for you, saving you hundreds of hours of work and thousands of dollars on bookkeepers and accountants.

With Finaloop's easy to use dashboard, you have access to your balance sheet at your fingertips in real time, constantly updated to represent any recent changes. Finaloop updates the balance sheet regularly providing you with real time information, rather than receiving quarterly or annual updates, as is typically done by an ordinary bookkeeper or accountant. With Finaloop you are always on the go, and never have to worry about the accuracy of your financial statements again.

Contact us for more information today.

The information provided on this website does not, and is not intended to, constitute legal advice. All information, content, and materials available on this site are for general informational purposes only. Readers are advised to consult with their attorney or accountant with any questions or concerns.

That’s what we’re here for.

Accurate ecommerce books, done for you.

100% accurate ecommerce books, available 24/7.

Finally, you can focus on everything else.