Setting Up Your Ecommerce Chart of Accounts: A Guide for Online Businesses

Your how-to guide to creating the best ecommerce chart of accounts for your business.

Every DTC brand is justifiably concerned with their profit & loss statement (P&L). At the end of the day, you need to know if your business can put real money into your bank account. But, don't underestimate the powerhouse of knowledge the balance sheet can be if you know how to use it.

The balance sheet shows you (and your lenders / investors) if your company has sufficient resources (like cash) to operate the business and pay off of its debt.

For example, let's say you have 2 businesses with identical net income. You self-funded Company A by investing your savings of $70k and didn't borrow a penny. To fund Company B, you borrowed $70k from friends & family and you have to pay them back with interest.

Looking only at the P&L tells you they are equally financially healthy. The balance sheet is the report that can help give you the full picture. Given how central they are to ecommerce accounting and bookkeeping, in this guide we'll cover both.

What is an Ecommerce Chart of Accounts (CoA)?

A chart of accounts is a financial tool — a hierarchical structure (list)— that orders the categories for your business’ transactions.

It’s the brain as well as the backbone of bookkeeping.

Framed in the least exciting way possible, a chart of accounts determines where the rows of money-in versus money-out get placed in your books.

What Chart of Accounts Should My Business Use?

Our CoA is based on best practices after years of working with various DTC brands like yours + extensive experience in accounting and tax. It's been through rounds of due diligences and reviews — so it's tried and tested.

Our CoA has more than 300 accounts to give you real data insights into your business. We won't include all 300 accounts here (you're welcome) but we will show you the key accounts and breakdowns we use for our customers.

Your Balance Sheet

Current Assets

1. Bank accounts

Your bank account section should include all bank accounts and digital banks used for the business. Examples of digital banks include Paypal, Payoneer, and BlueVine.

A note about Paypal: Paypal can function as a payment service provider (PSP) for your online store and can also act as bank. Cash is often transferred from your bank account or credit card to Paypal or from Paypal to your bank account. Make sure your Paypal transactions are not double-counted by treating these transactions as transfers and not as expenses.

With Finaloop, we'll automate this process for you so you can be sure your transactions are not double-counted.

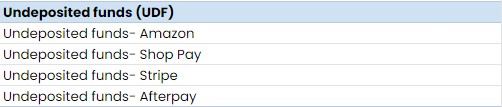

2. Undeposited funds

Undeposited funds are funds you already earned from sales but haven't yet been deposited into your account from your PSP. Tracking this amount is important for understanding your expected cash flow and for making sure your income is correct for tax purposes.

Finaloop integrates with your various apps and PSPs and syncs this data real-time. If you are doing your own bookkeeping or using a bookkeeper, make sure this information gets added each month.

3. Accounts receivable

This should include any wholesale invoices you send to your wholesale customers or other income sources you expect to receive in the future.

4. Inventory

If you are a manufacturer, like many CPG brands, you may prefer to track your inventory in 2 separate accounts - one for supplies & materials and the other one for finished products. As a reseller, you may prefer to track everything in one inventory account.

There is A LOT to consider about the best ways to track your inventory and COGS. You can read more about accounting for inventory here.

5. Loan receivables

For loans from related parties, the IRS has pretty specific conditions you need to meet to treat them as loans and not investments. One important condition is charging interest.

If you have related party loans (for example, from you to the company) that are over $10k, we recommend speaking to a professional, like Finaloop, to make sure it gets treated correctly.

6. Other current assets

Long Term Assets

1. Net fixed assets and intangible assets

Fixed assets and intangible assets are long-term assets used in your business with a useful life of more than 1 year. If you own these types of assets, make sure you are depreciating or amortizing them correctly to avoid issues from the IRS.

Fun fact: If you purchase a fixed asset for $2,500 or less, you can take the full expense this year rather than treating it as an asset and depreciating it over a few years.

2. Other long-term assets

Current Liabilities

1. Credit cards

Your balance sheet should include all credit cards used for your business.

Note that if the credit card is used for the business but is actually a personal card in your name or another person's name, the treatment can be a bit different.

2. Accounts payable

We recommend to only include net term bills as accounts payable (e.g, amounts owed to your vendor). No need to add an accounts payable for each upcoming payment.

3. Deferred revenue

This section covers income you received but have not yet earned, such as an upfront payment from a wholesale customer or a gift card purchase in Shopify.

4. Loans

Many ecommerce loans or financing arrangements, like merchant cash advances, have different accounting or tax treatment than traditional loans.

Here are the links to learn more about Shopify Capital, Amazon Lending, and Clearco. In the accounts below, we included some common examples our customers use so you get an idea of what the loan section may look like for yourself.

5. Other current liabilities

Long-term Liabilities

Long-term liabilities are debts you owe that you don't need to pay for at least 12 months.

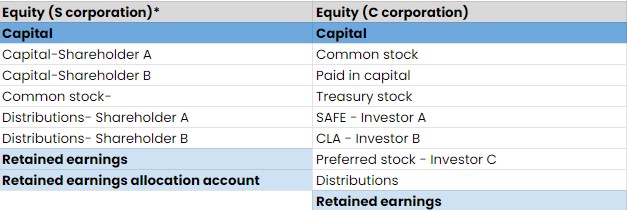

Equity

Equity can be quite confusing and is treated differently for different entity types.

You should consider both the type of legal entity you are - a sole proprietor, LLC, partnership, or corporation - and the type of tax entity you are - Schedule C filer, partnership, S corporation, or C corporation - to make sure your CoA can track all the details you need for your business and for your taxes.

Below are examples of different equity sections for different type of entities.

Your Profit & Loss Statement

1. Sales

Sales should include your gross sales amount for each of your various income sources.

Finaloop integrates and syncs directly with many sales apps like Shopify, Amazon, Walmart, eBay, Stripe, Shop Pay, Paypal, etc. in order to pull in the data real-time and map it to your P&L accounts.

It’s highly recommended to use an app that integrates with your sales channels to break down this data without a significant amount of manual work on your side.

Let's say you sell your organic quinoa snacks in your branded store on Shopify, Amazon, as well as wholesale to Wholefoods. Here is an example of how your net sales in your P&L should look:

2. Cost of goods sold (COGS)

There are different ways to track your COGS depending on whether you track it based on the cash basis where all of your inventory purchases during the month are recorded as COGS or accrual basis where you record your COGS based on the cost of the actual units sold.

Here you can learn more about the fundamentals of accounting for inventory.

COGS should also include shipping-out costs to ship your product to customers and merchant transaction fees that you get charged per transaction. Here is a sample COGS breakdown:

3. Operating expenses

The key to breaking down your expenses is including enough detail to give you data and insights you need to properly manage your business but not too much detail that it becomes impractical and inefficient to manage.

Here is an example of how we breakdown the operating expenses for our customers.

There are many different potential accounts and not every account applies to every company, so every P&L should look a bit different depending on the needs of your business.

4. Other income and expenses

Not all income and expenses are part of your regular operating expenses. Here is an example of some accounts that should be included in a separate section of your P&L:

5. Interest and Taxes

Last but not least, here is a sample of how the interest and taxes section of your P&L should look:

The Right Chart of Accounts for Your Ecommerce Business

Setting up the right chart of accounts creates an opportunity to get real value from your financials.

If you’re looking for custom-tailored bookkeeping and accounting specially for your online brand, see if Finaloop can help.

That’s what we’re here for.

Accurate ecommerce books, done for you.

100% accurate ecommerce books, available 24/7.

Finally, you can focus on everything else.